FOMC-Ya Later

Will the Fed rain on the bulls parade tomorrow?

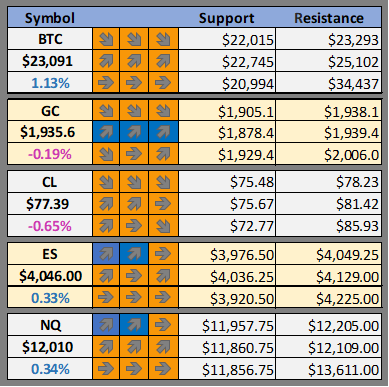

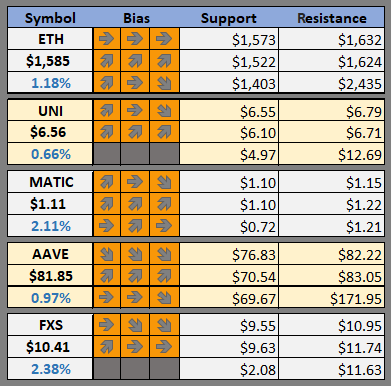

Cheat Sheet -

Support and resistance levels and our daily, weekly and monthly bias on BTC, GC, CL, ES, and NQ as well as our favorite altcoins

Are you new to Foot Guns? Learn how to read the cheat sheet here.

What We Are Watching

We further breakdown our case for these cryptos here : What We Are Watching

Crypto News

Celsius failed to report $800 million in losses as CFO flagged 'possibly illegal' behavior (The Block)

Co-signers of Bankman-Fried’s $250 million bond a step closer to becoming public (The Block)

Investment Manager Hamilton Lane Opens First Tokenized Fund With Securitize (CoinDesk)

Sam Bankman-Fried Seeks Right to Transfer FTX's Crypto (CoinDesk)

SEC settles on security claim in LBRY case; community calls it a big win for crypto (CoinTelegraph)

105-Year-Old German Bank Readies To Offer Crypto Services (Blockworks)

Elon Musk Eyes Twitter Payments: ‘Fiat First, Crypto Later’ (Blockworks)

Defunct Crypto Lender BlockFi Granted Approval to Sell Assets (Decrypt)

Osprey Funds Accuses Grayscale of ‘Unfair’ Practices in Lawsuit (Decrypt)

FTX Sister Firm Alameda Hits Bankrupt Voyager Digital With $446M Lawsuit (Decrypt)

BTC Outlook

If you’ve had your head under a rock, last year the Federal Reserves increased interest rates from nearly 0 to 4.25 percent. While, 4.25 is not a historically high number the rate of change of the increase was historic. What’s most important for crypto participants is this rise in interest rates has created a space for risk off assets to provide a safe return to investors. In general this has caused money to flow out of nearly every risk asset in the world and into fixed income or even just cash.

Bitcoiners’ dream of a future where the USD is no long a widely used store of value is not here. The USD provides amazing optionality, especially in uncertain times when money is flowing out of risk assets and searching for safety.

BTC has rallied nearly +50% in the first month of 2023 and many are trying to justify that this rally is predicting the Fed will ease on its policy earlier than expected because inflation numbers are coming down. This seems unlikely and others agree:

“Although the F.O.M.C. might be inclined to adjust this language as it approaches a pause, doing so at this meeting has little upside and risks widening the gap between the market and the Fed,” Matthew Luzzetti at Deutsche Bank and his colleagues wrote in a meeting preview.

Most likely BTC’s rise in January was more about filling the void that was created by FTX’s blow up forcing many to sell at low prices. If the fed holds onto it’s current path its likely BTC will go into a consolidation phase and could retest low $20k, or even the year open.

Of course anything could happen, the Fed could pivot tomorrow and risk assets go to the moon.

In any case cash (USD) still gives great optionality. You can buy high and sell higher if the brakes are taken off the market tomorrow.

Join us in discord where we actively discuss markets and where Bitcoin could be headed next.

Possible Course of Action

Cash is King - Have the optionality to respond to whatever the Fed does.

Take profits if long from early January

The Bulls’ Defense:

Currently trading above 200 day MA

Inflation coming down

The Bears’ Prosecution:

Fed likely to stay the course, continue holding interest rates high, which will continue to tame risk assets

A Closer Look

This section will be focused on taking a closer look on what Hal thinks is important to watch in the coming week.

This morning Hal looks at Longnecks and a sidechain that’s been all the rave!